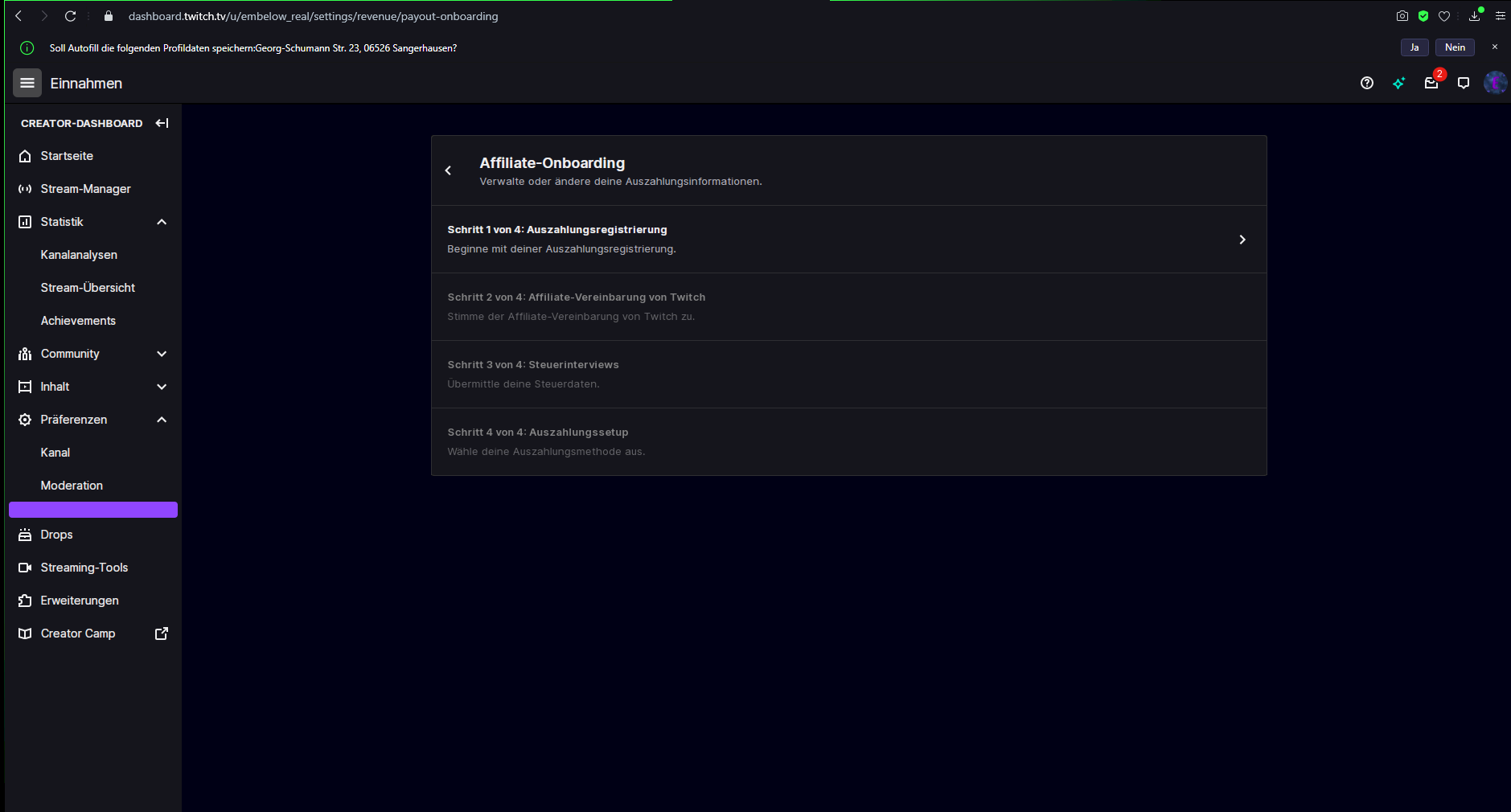

How about affiliate onboarding on Twitch?

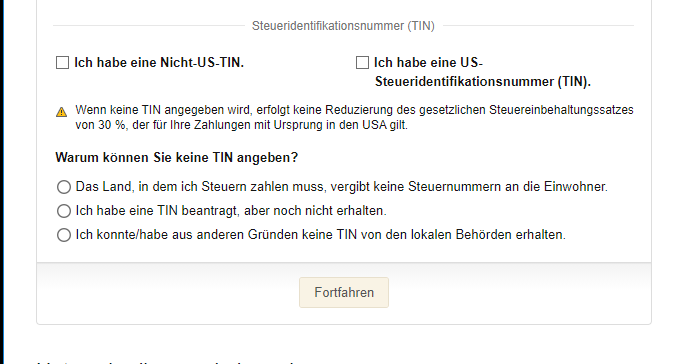

I found out today that I can activate affiliate onboarding. However, there's something with a tax return and as such a snot. What do they mean with the taxes etc. I heard that you first have to file a tax return if you earn more than 9k a year. Can someone explain that to me exactly?

You have to file a tax return if you have income from self-employed work. No matter what you deserve. So indicate income.

Ahh ok

Ok and what do they want with it?

Because my mother and I don't pay taxes because we get unemployment benefits

Well, what does that have to do with the fact that if you earn money outside of an employment or employment relationship, you have to declare it for tax purposes?

At Youtube you will be informed that you have to register a business as soon as you start earning money with it. That will be the case with all affiliates.

Whether you have to pay taxes has nothing to do with the fact that you have to report it to the tax office.